NEW YORK — It’s a brutal second for ed tech corporations.

The inventory market has been battered over the previous few months, and the expertise sector has been significantly onerous hit. In the meantime, schools are experiencing enrollment declines on the similar time their coronavirus aid funds are drying up, doubtlessly constraining how a lot they will spend with distributors.

Nonetheless, ed tech CEOs and traders remained bullish about their very own sector’s future throughout a convention in New York on Thursday held by HolonIQ, a market evaluation agency. Listed here are three tendencies they are saying are coming down the pike.

Ed tech will overcome powerful market circumstances

Shares have been trending downward for a lot of the 12 months, reaching a brand new low Friday after the Federal Reserve raised rates of interest once more in a bid to battle hovering inflation.

Ed tech shares have been feeling the squeeze. Shares for 2U, which owns MOOC platform edX, closed at $5.78 on Friday, down from about $35 a 12 months in the past. Shares of Coursera, a distinguished MOOC platform, have been additionally buying and selling round $35 in September of final 12 months. On Friday, they closed at $10.25.

These market tendencies have vital implications for ed tech corporations, particularly people who had been weighing an preliminary public providing, in response to traders who spoke on a HolonIQ panel Thursday.

“We see an IPO window that’s closed for fairly a bit,” mentioned Shoshana Vernick, managing director at Avathon Capital. “In the event you’re an organization that’s needing money and has to go increase cash proper now, it’s very tough.”

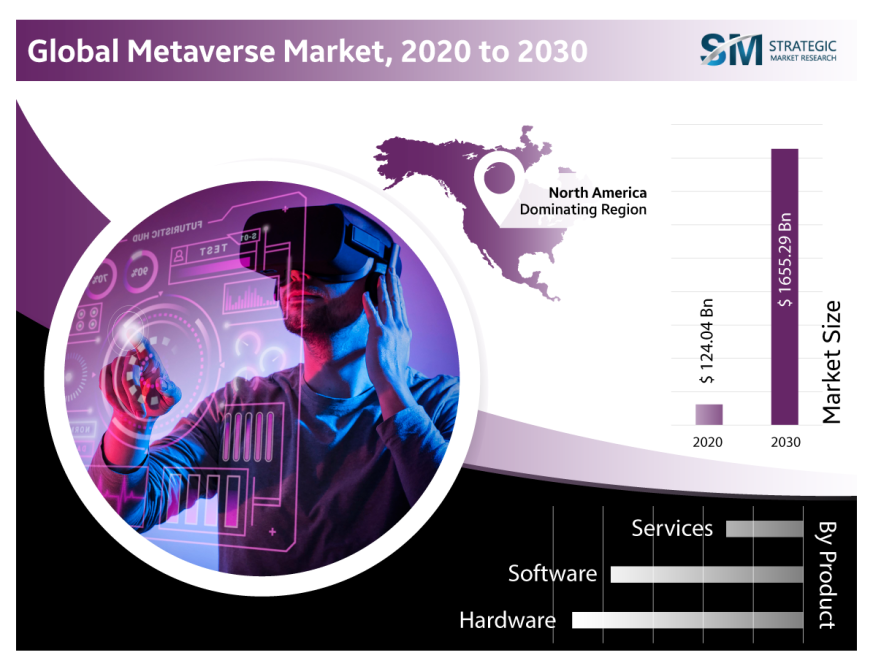

Nonetheless, audio system listed causes to anticipate optimistic long-term tendencies. Just a little over 10 years in the past, solely about $500 million of enterprise and progress capital was flowing into the ed tech market, mentioned Michael Cohn, accomplice at GSV Ventures.

That’s in comparison with greater than $20 billion in 2021. Regardless of uncertainty concerning the future, Cohn predicts an “upward trajectory.”

Chip Paucek, CEO and co-founder of 2U, acknowledged the powerful market circumstances.

“I present up at cocktail events proper now, and folks go, ‘How are you?’” he mentioned. “As a result of, clearly, it’s not been nice these days. And we take that very severely. Our shareholders are a vital neighborhood for the corporate.”

Nevertheless, Paucek mentioned 2U’s latest strikes — which included buying edX final 12 months to rework into an organization with a consumer-facing platform — are setting it up for the lengthy haul.

“This firm is far, a lot stronger than it was once we have been at our peak value,” Paucek mentioned.

Microcredentials are increased ed’s future

Chief executives at two giant ed tech corporations touted new microcredentials out there on their platforms, stressing that these smaller choices will likely be a key a part of increased training’s future.

In Could, Coursera launched Profession Academy, a expertise coaching academy the place customers can earn entry-level certificates from corporations like IBM and Meta, Fb’s mum or dad. Coursera is promoting the platform to high schools, which might make it out there to their college students.

Jeff Maggioncalda, Coursera’s CEO, likened Profession Academy to Shopify, an e-commerce platform that permits retailers to shortly arrange on-line shops. Faculties can use Profession Academy to launch a expertise academy with their very own branding.

“Once they graduate they’ve a university diploma, and so they have an expert certificates from Google,” Maggioncalda mentioned. “That graduate goes to do higher than one who simply has a university diploma, or somebody who by no means went to school and simply received an expert certificates.”

2U can be doubling down on microcredentials. The corporate introduced Thursday two new credentials it calls Microbachelors, that are applications composed of some courses that may result in school credit score from edX’s accomplice establishments.

The 2 new Microbachelors, that are each centered on statistics, will likely be provided via the London Faculty of Economics and Political Science, a part of the College of London. The varsity additionally launched a introductory math course on the platform that’s free to audit.

College students who full one of many Microbachelors and are accepted into sure applications on the College of London will likely be eligible to obtain credit score for 2 half programs. The applications are pending recognition for credit score by New Jersey’s Thomas Edison State College, in response to edX’s web site.

“That could be a excellent stacked pathway,” mentioned Paucek, 2U’s CEO. “That’s a lot tougher to tug off than most individuals exterior of upper ed would understand.”

Paucek described the choices as “sensible for enterprise,” saying it should enhance the advertising funnel for College of London’s on-line bachelor’s levels provided on edX’s platform.

Corporations will proceed to supply instructional advantages

Ed tech corporations and traders anticipate studying and dealing to change into extra intertwined sooner or later.

Coursera, as an illustration, sells entry to its content material libraries to corporations, governments and different organizations which can be fascinated about coaching their staff. In 2022’s second quarter, this phase of Coursera’s enterprise introduced in $43.7 million, up 55% from a 12 months in the past.

These efforts may assist the corporate attain learners it may not in any other case appeal to, Maggioncalda mentioned.

“There’s a whole lot of people who don’t find out about Coursera. They’re not going to return to Coursera,” he mentioned. “However they may be in a authorities workforce improvement program, the place an establishment can information them to the place the alternatives for jobs are and might information them to make use of Coursera in a sure means.”

Cohn, of GSV Ventures, echoed these feedback, saying he expects corporations will proceed to supply sure instructional advantages. GSV Ventures has invested in Guild Schooling, a tuition advantages platform that connects employers to its platform for on-line schools.

“Whether it is, ‘Oh, right here’s $100 for MasterClass,’ that’s most likely going away — you realize, superficial, fluffy studying as a profit.” Cohn mentioned. “But when it’s studying that drives the future-proofing of a company — the upleveling, the upskilling of the individuals in a means that’s measurable, demonstrable in opposition to enterprise aims — we predict that that’s going to be a long-term pattern.”