Although chip shares have offered off exhausting in tandem these days, some chip corporations look a lot better positioned than others to brush off the demand weak spot that is forming in a number of end-markets.

Likewise, some enterprise tech corporations look nicely positioned to climate potential IT finances cuts, whereas others might get hit exhausting.

To be clear: I nonetheless do not assume we’re heading into a serious recession. Not solely do the job market and shopper stability sheets/spending nonetheless look fairly wholesome general, we’re now seeing inflation cool off in some areas the place it had been operating fairly scorching (sturdy shopper items, uncooked supplies, delivery/freight prices, and to some extent house costs), at the same time as power and meals inflation stay very excessive. And the easing of some inflationary pressures might very nicely maintain the Fed from getting too aggressive with charge hikes and balance-sheet reductions.

However with that mentioned, the unfavorable wealth results created by the carnage seen in each equities and cryptos is sure to have an effect on shopper spending some, in addition to (together with increased mortgage charges) decelerate the housing market. As well as, excessive power/meals inflation has begun weighing on discretionary spending by lower-income customers, and although company spending/hiring nonetheless would not look dangerous general, there are pockets of softness in areas reminiscent of model advert spending and hiring exercise amongst tech corporations contending with enterprise pressures and/or plummeting inventory costs.

As well as, there’s now a transparent shift in discretionary shopper spending away from sturdy items (notebooks, TVs, furnishings, sporting items, and so on.) in the direction of journey and hospitality companies. And the truth that costs have gone up for issues reminiscent of flights, resort rooms and restaurant meals implies that customers keen on spending extra on companies than items proper now could have much less disposable earnings to direct in the direction of the latter.

In a nutshell, such an surroundings spells cross-currents for tech buyers to navigate. The macro surroundings is not as dangerous as some die-hard bears make it out to be — and positively, plenty of dangerous information has already gotten priced into the shares of many tech corporations which can be dealing with some demand pressures. Nonetheless, taking a selective method in the direction of tech longs — with a bias in the direction of corporations working in markets prone to see demand maintain up nicely on this surroundings — arguably makes plenty of sense.

Amongst chip shares, corporations whose gross sales skew in the direction of automotive, industrial and/or cloud knowledge heart end-markets, reminiscent of Analog Units (ADI) , Texas Devices (TXN) or Marvell Expertise (MRVL) , might see demand maintain up a lot better than corporations which can be closely depending on shopper tech end-markets, reminiscent of Qorvo (QRVO) , Synaptics (SYNA) or (because the Q2 warning it shared on Monday drives house) Himax Applied sciences (HIMX) .

Inside enterprise tech, cloud software program suppliers reminiscent of Salesforce.com (CRM) , ServiceNow (NOW) and Workday (WDAY) — lots of which now look a lot inexpensive than they did a number of months in the past — would possibly see demand maintain up higher than enterprise tech corporations whose gross sales nonetheless rely closely on conventional, on-premise infrastructures, reminiscent of Dell (DELL) , Hewlett-Packard Enterprise (HPE) and IBM (IBM) . Public cloud giants reminiscent of Amazon.com’s (AMZN) AWS and Microsoft’s (MSFT) Azure might additionally see demand maintain up comparatively nicely.

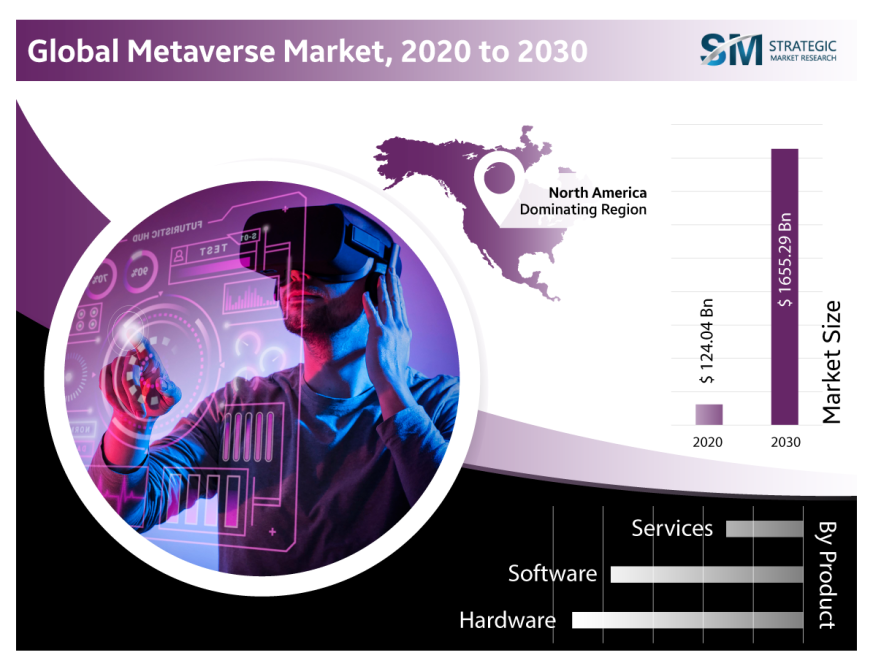

The enterprise software program business’s shift in the direction of subscription and consumption-based enterprise fashions relative to license/upkeep income fashions performs a job right here, as does the long-term shift in enterprise IT spend in the direction of software program/cloud spending relative to {hardware} spending. One solely has to take a look at the next knowledge from Morgan Stanley’s Q1 CIO survey to see how enterprises confronted with IT finances cuts will usually prioritize software program and cloud spending areas (safety software program particularly) relative to on-premise spending fields reminiscent of {hardware}, consulting and knowledge heart building:

CIO responses on which tasks they’d lower spending on throughout a downturn. Supply: Morgan Stanley.

As Snap’s (SNAP) Q2 warning highlights, on-line advert gamers are additionally weak to finances cuts proper now. This notably holds for corporations extremely uncovered to e-commerce advert spend (impacted by reopening exercise and the shift to companies spend) and/or model advert spend (usually one of many first issues to get lower when corporations get jittery about their demand surroundings).

On the flip aspect, on-line journey corporations reminiscent of Reserving (BKNG) , Expedia (EXPE) and Airbnb (ABNB) look nicely positioned to profit from rising journey spending — particularly since increased costs spell extra income per reserving.

A few of these traits will most likely come into focus extra as earnings season begins to unfold subsequent month. Many, many, tech shares look oversold proper now, and with investor sentiment at exceptionally low ranges proper now, the sector might quickly see a bounce. However some tech corporations arguably have a greater shot than others at sustaining any momentum that types over the subsequent couple of weeks into July and August.

(ABNB, AMZN and MSFT are holdings within the Motion Alerts PLUS member membership. Wish to be alerted earlier than AAP buys or sells these shares? Be taught extra now. )

Get an e mail alert every time I write an article for Actual Cash. Click on the “+Comply with” subsequent to my byline to this text.